Create a Website Account - Manage notification subscriptions, save form progress and more.

- Home

- Government

- Political Subdivisions

- Service Authority

- About the Authority

About the Authority

NOTE: The video above was created in fall 2023. The only information that is dated is the composition of the board of directors. It is now comprised of four board members and one resident.

What is a service authority?

In Virginia, a service authority is formed when one or more governing bodies agrees to provide public water and wastewater services to its residents under the powers conferred by the Virginia Water and Sewer Authorities Act of 1950.

The service authority operates as a public body politic and political subdivision, which means that the Commonwealth of Virginia views the authority as its own entity separate of, but still affiliated with, the county.

As such, the authority is comprised of a non-partisan board of directors. This board has five members, currently comprised of four representatives from the board of supervisors and one appointed by the board of supervisors as representative of neighborhoods served by the authority. The Board of Directors appoints its own chair and vice chair and establishes policies, adopts a budget, sets rates, and oversees operations.

-

Cathy Binder

Shiloh District SupervisorPhone: 540-684-7721

-

Bryan Metts

James Monroe District SupervisorPhone: 540-684-7357

-

Lee Robotham

Service Authority Board of DirectorPhone: 540-621-9238

-

David Sullins

Chair, At-Large District SupervisorPhone: 540-684-2500

-

William Davis

Vice Chair, Dahlgren District SupervisorPhone: 540-684-7356

The board appoints a general manager, who serves as the chief administrative officer and supervises daily operations, hires operating staff, and carries out the orders of the board. While the board can designate and hire its own staff to carry out additional functions of the authority, the board may instead request to utilize the resources of the county. The service authority currently receives assistance from many county departments, including administration, legal, finance and procurement, human resources, and engineering.

The service authority works diligently to meet state and federal regulatory standards and permit requirements for the wellbeing of King George’s health, safety, and environment.

Service authority meetings are open to the public. The board of directors meets regularly on the first and third Tuesday of each month at 5:30 p.m. in the board room at the administration building. Agendas and minutes are published online here. The public is encouraged to attend these meetings to get involved and learn more about the service authority.

More information on meetings and the board of directors can be found here.

When was the King George Service Authority established?

The King George Service Authority was established in 1992 and began with the acquisition of public water and wastewater utility services provided by various neighborhoods in the county, including the Dahlgren and Fairview Beach Sanitary Districts.

As more housing developments were completed, the service authority expanded to provide utilities to more customers. From approximately 900 customers in the 1990s to nearly 4,600 customers today, the service authority has grown to accommodate water and wastewater services to nearly 17 percent of King George residents.

What is the financial structure of the service authority?

Although service authorities can levy taxes in Virginia as a revenue source, this is seldom used once an authority is well established financially. Most authorities’ largest revenue source is the monthly or bimonthly charges for services provided to customers.

For the King George Service Authority, general funds were utilized to purchase initial water and wastewater systems in the 1990s and have rarely been used since. Once the authority had management over these systems, rates quickly became the primary revenue source, shifting service authority financial operations to an enterprise fund.

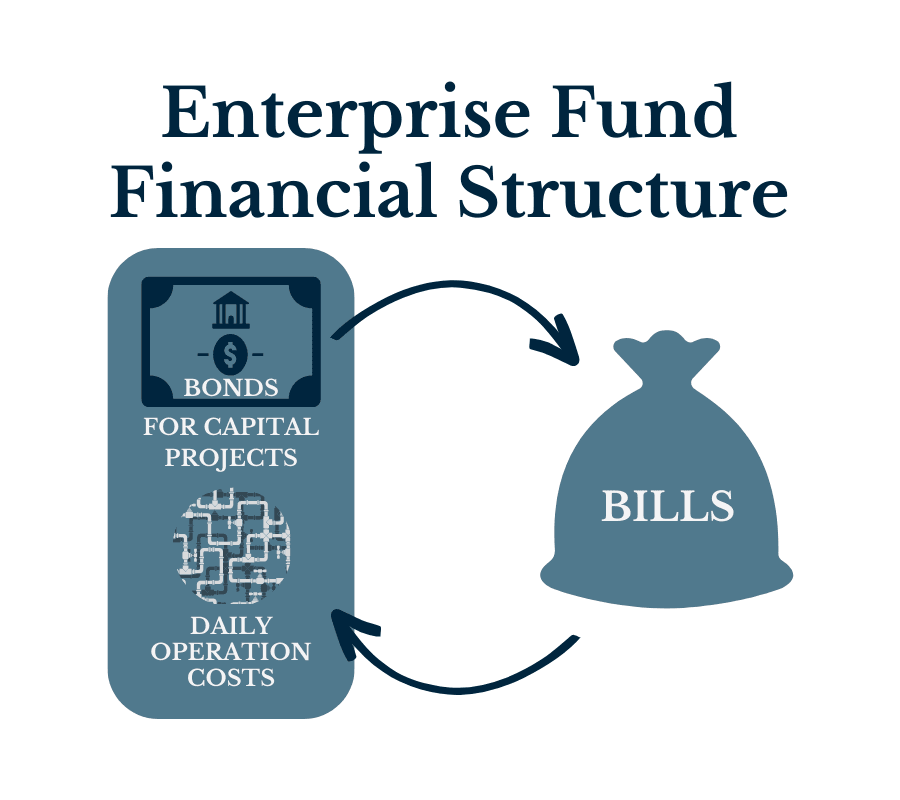

An enterprise fund utilizes revenue collected from bills for water and wastewater services solely as a reinvestment into service authority operations. As part of an enterprise fund, customer rates are designed to recover operational costs.

If the service authority needs to spend monies not available in the enterprise fund, then the service authority will leverage its credit to apply for the issuance of a bond. The service authority has very strong credit in conjunction with the county.

Bonds are typically sought as a solution to fund large projects like infrastructure improvements, such as replacing depreciating assets like treatment plants, wells, and water and sewer lines.

The service authority borrows monies utilizing bonds, then plans repayment of the principal and interest over time through the collection of rates and fees by its customers as users directly benefit from the improvements; this process maintains the service authority’s enterprise fund financial structure.